vat letter to customers

Uniquely identifies this particular card number. Although the VAT amount appears on the sales update report the system does not record it in the VAT Payables account until you post the invoice.

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate Request Letter Example Literal Equations Cover Letter Template

If this happens it could result in your customers being charged VAT additionally on delivery along with a small handling fee.

. The amount of VAT to pay can vary depending on several factors. Our defining promise is to make you feel at home in our London and central London hotels. That said you may still need to buy some taxable items to conduct your business in which case you must still pay VAT on those items and cannot reclaim VAT credit for those purchases.

Our VAT returns service costs 400 for old customers. VAT is considered indirect tax while Percentage Tax is direct tax. Output tax is the VAT that is charged by the business operator when he himself supplies goods or services to his customers.

When you enter a sales order with VAT tax tax explanation code V and run Update Customer Sales R42800 the system uses distribution AAIs to record the Cost of Goods COG Sold and Inventory accounts. View our wide range of Construction BoardsWhether you or your customers are busy creating en-suites installing bathrooms building loft conversions or extending into basements our products should be part of your range. This leave us underling-VAT-paying citizens no option but to either donate everything to charity and walk all the way.

The first two are the classic country code in this case ES. Some examples of zero-rated items include books newspapers childrens clothes and shoes and goods you export to non-EU countries. The goods andor services listed below are.

VAT in France. Banks continue giving their customers a hard time. It can be added to the selling price or service fee collected from customer.

Thistle Hotels offer fantastic affordable quality across all our locations. As a general rule periodic VAT returns in Germany must be filed and paid by the 10 th day of the month following the reporting period. Companies registered via fiscal representative will be allocated a due date depending on their legal form and the first letter of the business name.

Letterhead printing is available on a variety of paper types and thicknesses so whether you opt for a lightweight 90gsm or a sturdier 120gsm is all down to your tastes. 9 characters The last character must always be a letter. This format is not case-sensitive.

By Opinion Jan. Letter to UK VAT-registered businesses about guidance available to help them trade with the EU April 2021 PDF 117 MB 2 pages This file may not be suitable for users of assistive technology. This discrepancy is due to our systems billing you as a new customer.

The VAT identification number VAT ID and the tasks associated with it can be confusing and are generally a rather unwelcome topicIn our VAT ID Guide you will find everything you need to know about VAT the structure when you need such a number and much more. You are still required to record these sales in your VAT accounts and report them on your VAT return. Requires a letter.

To find a VAT number you may need to search online use a government database or search a company form. Consumers and businesses pay value-added tax VAT when they purchase goods or services. Selling Price or Service Fee x VAT Rate.

The VAT registration number and your Identity Card Number should be included with your letter. You can use this attribute to check whether two customers whove signed up with you are using the same card number for example. Please find the credit notice of 60 attached to this letter.

A Value Added Tax VAT invoice is provided whenever VAT is assessed on Airbnb service fees. Obtain a letter from the tax authorities if a business customer is a new business and a VAT number is not available 1 establish if the supply is exempt in the other Member State for the purposes of VAT Information Exchange System VIES include the supply on the VIES return if it is taxable. Service Fee P10000 VAT P1200 Total Collected P11200.

Choose the icon enter Customer or Vendor and then choose the. Specimen letter to be. You need to use the correct VAT number when invoicing documenting or providing receipts for customers and businesses.

Value Added Tax in local language is Taxe sur la valeur adjoute VAT in Europe. A value-added tax identification number or VAT identification number VATIN is an identifier used in many countries including the countries of the European Union for value-added tax purposes. VAT exemption means that you cannot register for any VAT scheme because you do not sell any taxable items to your customers.

Originally the Spanish VAT number was known as Código de Identificación Fiscal. Address and the Value Added Tax identification number of the supplier. We deeply value each interaction with our customers and believe in providing right.

German VAT due dates. For payment methods that tokenize card information Apple Pay Google Pay the tokenized number might be provided instead of the underlying card number. As an indirect tax Value Added Tax VAT can be passed on to the customer.

This is followed by a letter seven digits and finally another letter resulting in the following format. Zero-rated goods are still VAT-taxable but the rate of VAT that you charge to customers is 0. The NIF consists of a total of eleven characters.

VAT JCT GST or service tax is charged at the time of payment and is based on the total guest service fee for a reservation unless noted otherwise below. Choose whether to tuck all your contact details into one corner or put your vital info at the foot of the page ready to remind your customers each time they turn over. Finding the right VAT number can be tricky because the process is often different for each country.

Your invoice is finalized and issued when a reservation is accepted and includes your information name address etc as you entered it in your Airbnb account. To assign VAT business posting groups to customers and vendors. In case the Dauerfristverlängerung extension applies the due date is extended to the 10th day of the second month following the reporting periodFor example the first quarter VAT return is normally due.

If you change your reservation VAT JCT or GST adjusts to reflect any change in the service fee. In the EU a VAT identification number can be verified online at the EUs official VIES website. It confirms that the number is currently allocated and can provide the name or other.

Where the total amounts of sales to French customers in any 12 month period exceeds this. Airbnb is not able to modify a VAT invoice after its been issued. 21 Customers who are entitled to receive tax and duty-free goods and services.

I hope this clears up any confusion you had about your recent purchase. Country codes two letters are inserted before the VAT number if the company is using the number for the purposes of intra-community trade. On certain items where the VAT rate is not 25 - which is mainly books and magazines - these may go out in the ordinary VAT flow where VAT and other charges are added.

Below is a summary of the standard formats for each EU country plus.

Belgium Crelan Bank Account Closure Reference Letter Temp In 2021 Reference Letter Reference Letter Template Lettering

Modern Mailing Label Designs Free Acilmalumat Within Usps Shipping Label Template Downlo Free Business Card Templates Invoice Template Event Planning Worksheet

British Gas Bill Bill Template Bills Gas Bill

Explore Our Free Roofing Warranty Certificate Template Certificate Templates Free Gift Certificate Template Gift Certificate Template

Commercial Invoicing Sample Ups Format Invoice Template Word Invoice Template Purchase Order Template

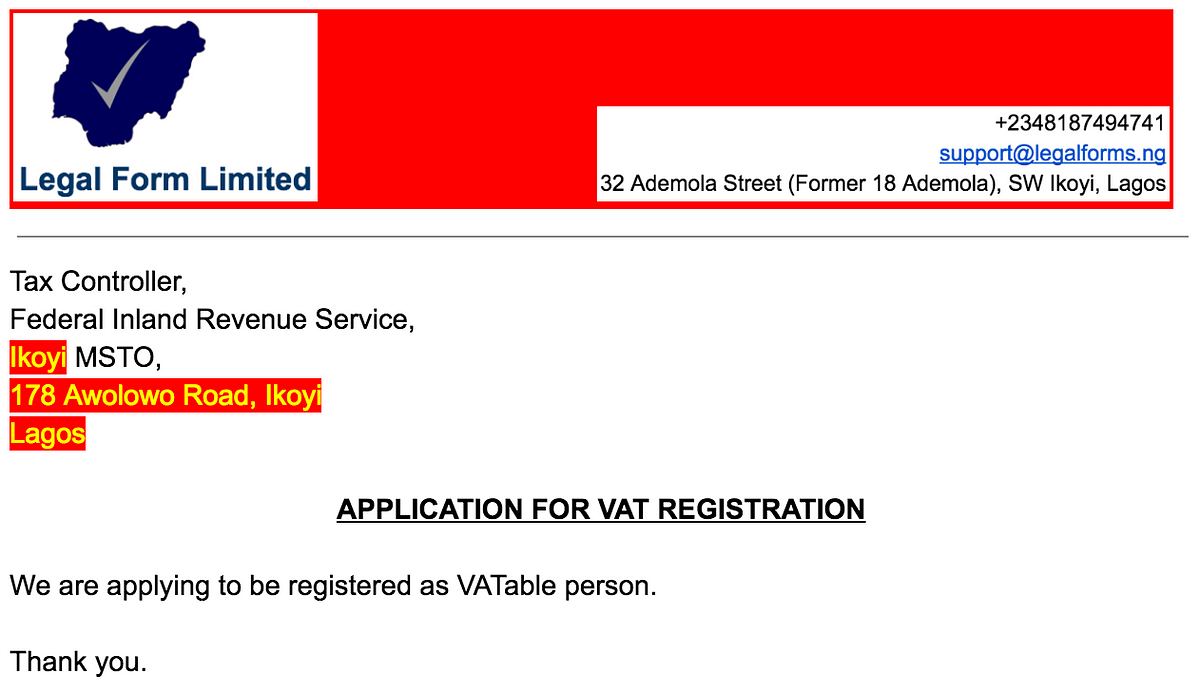

Vat Application Letter This Short Article Will Show You A By Legal Forms Medium

Commercial Invoice Templates 16 Free Printable Xlsx Word Samples Invoice Template Word Invoice Template Words

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate Request Letter Example Literal Equations Cover Letter Template

Brochure On Google Docs Tax Refund Donation Letter Lettering

Pin On My Saves

Pin By Office Templates Online On Office Templates Be An Example Quotes Quotation Sample Quotations

Value Added Tax Vat Infographic Value Added Tax Ads Tax

Vat Sales Invoice Template Price Including Tax Invoice Template Word Invoice Template Free Resume Template Download

Europe Search Marketing Marketing Plan Template Business

Letters To Customers Increasing Price Due To Vat Canvasing Advertising Window Cleaning Forums Uk S 1 Window Cleaners Forum